general

Social insurance key figures 2021

Corporate fee for radio and television

Under the Federal Radio and Television Act (RTVA), the Federal Tax Administration (FTA) has been mandated to collect the radio and TV levy from businesses from 1 January 2019. For companies, the tax obligation is now based on the turnover declared in the VAT statement. Companies with an annual turnover of less than CHF 500,000…

Read MoreVAT obligation in Switzerland for foreign companies

As of 1 January 2018, foreign companies must register for Swiss VAT if they generate turnover in Switzerland. This applies from the first franc, unless the company is a small enterprise. The worldwide turnover is used to assess the size of the company. If the turnover amounts to more than CHF 100,000 (around 90,000 euros)…

Read MoreSponsoring FC Obersiggenthal

our football team! We wish you much success!

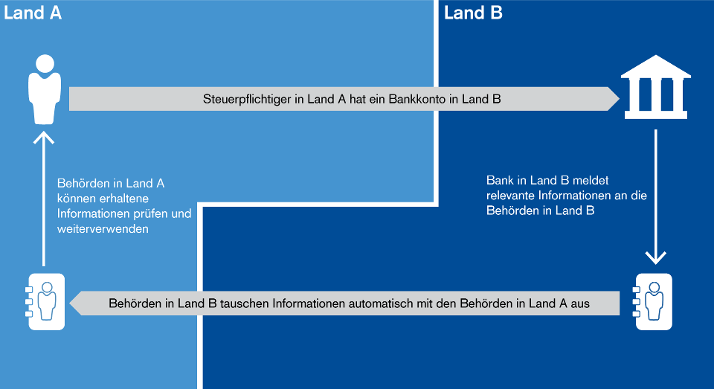

Read MoreHow the AIA (automatischer Informationsaustausch in Steuersachen = automatic exchange of information in tax matters) works

In the wake of the financial and debt crisis, combating tax evasion worldwide has become an important and widely pursued concern of the global community. The AEOI (automatic exchange of information) has now become a fact. Switzerland will also collect information and make corresponding reports abroad for the first time in 2018. The Federal Tax…

Read More